Many of our clients are using some type of eCommerce software solution. These sites are usually selling merchandise of some sort, be it jewelry, clothing, or vitamin supplements. Because of this, we have to help our clients find the right merchant services and payment gateway provider. The 2 most popular choices are PayPal (An All-In-One Solution) and Authorize.net (A Payment Gateway Processor) for online credit card processing.

• Authorize.net is the Internetʻs largest payment gateway (e-commerce) service provider allowing merchants to accept credit card and electronic check payments through their website. As businesses grow, companies tend to use Authorize.net over Paypal because of the traditional merchant account.

• Paypal is an e-commerce business allowing payments and money transfers to be made through the Internet. If you are a new store and you are unsure if you will make enough to support a gateway, Paypal is a good place to start.*

The following list will help YOU decide what is best for your new or aspiring business and your online payment processing needs.

1. How many transactions will your company be processing in a month?

Authorize.net uses $.10 per transaction, but carries with it a $99 setup fee, a $20 monthly fee, and a $.25 per batch fee (usually once or twice a day depending on how frequently you are using your payment center). For PayPal, there is a 2.2% to 2.9% per transaction fee plus an additional $.30 per transaction with no setup or monthly fee. PayPalʻs fee percentage depends on your companyʻs monthly sales, which brings us to the next question:

2. What is your monthly revenue?

Is a large portion of your companyʻs monthly revenue based on your retail sales? Do you make over $100,000 a month from your credit card sales? If so, your rate is much lower for use of PayPal (2.2% per transaction), but we would suggest the use of Authorize.net because it requires no monthly minimum revenue to give you its standard rate.

3. How computer savvy are you and your customers?

Finally, itʻs a question of how up to date is your company with technology? How tech savvy are your customers? Most people are familiar with PayPal because large sites like eBay use it for sales and as such are more comfortable using it. The other side of it is that Authorize.net is built directly in to the website and requires no outside management, meaning your customer stays on your site the whole time and is not re-directed to an outside page to make a payment. Sending the customer to a different page may deter them from making the purchase if it takes too many steps.

4. Online Security & Fraud?

Online security is a very important aspect of operating an online storefront. It is your job to ensure that your customers sensitive information is protected. PayPal does all this for you since it processes your transactions “off-site”, on their secure and encrypted pages ensuring that your customers sensitive information is safe. If you chose to process transactions “on-site”, using Authorize.net (which can have huge benefits) then you are required to setup and install a Secure Sockets Layer (SSL) Certificate. This is typically a job for your webmaster or website administrator. SSLs are designed to provide communication security over the Internet by allowing data flowing between both parties to remain encrypted. These SSL Certs are purchased and renewed yearly. Costs can greatly vary depending on the type of SSL Certificate you purchase. Average yearly costs for basic certs, with professional setup and install can range from $200 and up per year.

Ultimately, the choice is yours. If your company is using an online shopping cart as its primary function, youʻll likely want to go with Authorize.net, where as if your companyʻs websiteʻs main function is not to sell merchandise, or its focus, PayPal is the best option. In some cases, it’s hard to know the answers to these questions, especially if you are just starting out. In most cases, PayPal is probably the better option if you are new or just starting out in the world of eCommerce.

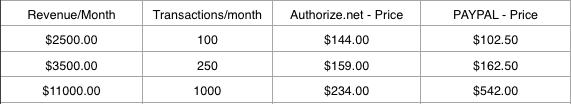

For a quick example, look at the chart below and see where you company stacks up.

Prices based on first month of service and enrollment in a PayPal Merchant Qualified account.

Prices based on first month of service and enrollment in a PayPal Merchant Qualified account.

There can be other factors specific to your business needs and strategies that could guide you decision better. There are also other options online you can choose from. Consulting with a professional can always help flush out the option that makes the most sense for you and your business.

*Online Resources – See more at: http://www.prometsource.com/blog/authorizenet-vs-paypal#sthash.38uLR34Y.dpuf

Click Here to sign up for an Authorize.net Account.

Click Here to sign up for a Business PayPal Account.

Thank you for sharing about online payment processing.